Trade Now, Settle Later: Unlocking Liquidity in DeFi

Founded: 2023

Contact: team@forwards.zone

Problem Statement

DeFi Trading is Broken—Atomic Settlement is the Culprit

Fragmented Liquidity

Users struggle navigating numerous DEXs and CEXs across multiple chains to find the best prices

Capital Inefficiency

Atomic settlement requires 100% pre-funding, locking up capital unnecessarily

Limited Trading Options

Impossible to trade assets with future availability (staked tokens, vesting assets)

Cross-Chain Complexity

Bridging assets is risky, time-consuming, and technical

MEV & Privacy Vulnerabilities

On-chain trading exposes users to front-running and reveals wallet holdings

Native BTC Trading

No truly decentralized way to trade native Bitcoin without bridging first

RWAs & Illiquids: P2P

Trading of tokens not suitable for CLOBs or AMMs

The Opportunity: Short-Dated Forwards

New Strategies Unlocked by Asynchronous Trade & Settlement

Price Locking

Lock in asset prices today for future delivery in mins/hrs/days

Delegated PoS Assets

Trade staked assets for future delivery post-unstaking

Vesting Tokens

Secure prices for locked Team/VC tokens without doxxing

Native BTC Trading

Trade BTC in cold storage, settle privately via trustless bridge

Future Yield Monetization

Lock in prices for staking, mining, or farming rewards

Hedging & Shorting

Hedge or short BTC/ETH/SOL with fixed-price agreements

Vision & Mission

Vision

To become the decentralized clearing house for all digital assets across all blockchains.

Mission

Reimagine DeFi trading with capital-efficient, cross-chain forward contracts that separate trade execution from settlement.

Solution Overview

Forward Contracts

Agreement now, settlement later (minutes to days)

Partial Collateralization

Only 1-10% of trade value required upfront

Asynchronous Settlement

Deliver assets at agreed time after execution

Cross-Chain Native

Trade any token for any other token across any chain

Single Interface

Access global liquidity through one unified platform

Market Opportunity

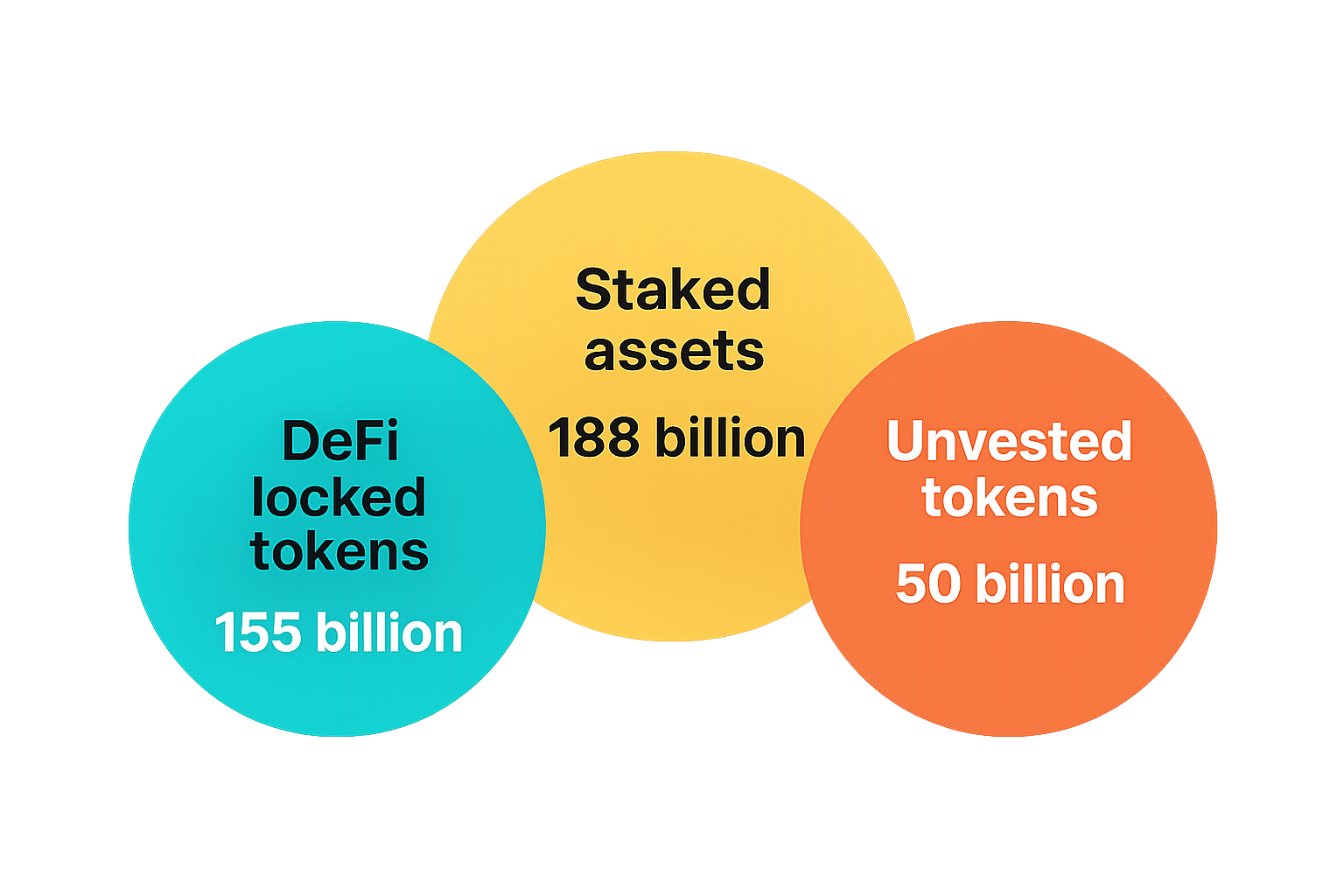

Unlocking Liquidity Across Emerging and Established Markets

-

Locked & Vesting AssetsUnlock liquidity in staked, vesting, and locked tokens to fund operations or seize market opportunities.

-

Bitcoin TradingEnable decentralized Bitcoin trading while preserving cold storage security and minimizing bridging risk.

-

Real-World Assets (RWAs)Tap into the $50B tokenized asset market, projected to exceed $10T by 2030, unlocking new liquidity opportunities.

-

Future Yield MonetizationMonetize staking, mining, and farming rewards before they're realized to unlock immediate liquidity.

-

Capital Efficiency for Market MakersIncrease trading capacity through partial collateralization, reducing upfront capital requirements.

New Market Targeted by forwards

Product Features

Market Orders

Instant execution with competitive pricing and future settlement

Limit Orders

Set price, validity period, and settlement terms with minimal collateral

Cross-Chain Settlement

Receive assets directly to your preferred wallet on any chain

Target Market & Use Cases

Unlocking Liquidity Across Key DeFi Participants

| Target Users | Key Use Cases |

|---|---|

| Retail Traders | Trade locked/staked tokens; buy tokens at discounts |

| VCs & Angel Investors | Forward-sell vesting tokens; lock in profits privately or via intermediaries. |

| Teams & Developers | Forward-sell vesting tokens to access liquidity anonymously or privately. |

| Foundations & Treasuries | Fund operations and growth by selling future vesting tokens, staking rewards, or protocol revenue streams. |

| Market Makers & Liquidity Providers | Short tokens with fixed costs; offset risk; earn spread; earn revenue as intermediaries or guarantors. Minimal capital required |

| Institutions (TradFi & Crypto) | Trade with KYC/AML-compliant counterparties; use fixed-rate hedging tools and forward contracts. |

| Validators & Miners | Lock in prices for staking/mining rewards; hedge future revenue streams. |

| DeFi Farmers & Yield Optimizers | Sell or hedge farming rewards; monetize future yields from DeFi campaigns. |

Technology Architecture

Optimized for High-Performance DeFi Trading Across BTCfi, RWAs, and Ethereum.

Custom Appchain Design

Built using Cosmos SDK and Tendermint Consensus for sub-second block times, tailored for short-term forwards trading.

Flexible Deployment

Operates as a standalone PoS blockchain or integrates as a rollup secured by Celestia or Bitcoin (via Babylon).

Cross-Chain Connectivity

Trustless bridges to BTCfi and RWA chains, with IBC links to Ethereum and prominent platforms like Ondo and Noble.

Seamless Integration

Designed to unlock liquidity and enable secure trading across diverse asset classes with high scalability.

Unique Features

Bespoke logic built into the blockchain

Order Matching

Central coordination layer

Collateral Management System

Efficient capital utilization

Cross-Chain Settlement Protocol

Secure delivery verification

Reputation System

Track trader fulfilment records

Anti-Default Measures

Escrow, reputational badges and buy-ins

FWD Token

Governance and order creation rights

Obligation Trading

Executed but not settled contracts can be novated

How it Works

Mechanism Behind Asynchronous Trade & Settlement

Order Creation

User creates a forward contract with specific terms and chooses the matching method (auction, limit or market order).

Matching

Order is matched with a counterparty. Terms of the contract are confirmed.

Contract Created

Escrow is secured from both parties, and the forward contract is finalized with delivery terms set.

Delivery Period

Tokens are delivered as per contract terms. Early or partial settlement is possible if permitted.

Fullfillment

Completion of the contract with final exchange of tokens. Escrow is released upon settlement.

Watch the MVP at product demo to see Forwards in action.

Business Model

Transaction Fees

Small percentage on executed trades

Order Creation Fees

Nominal fee for limit orders (reducible via FWD staking)

Settlement Fees

Fees for cross-chain settlement verification

Yield Generation

Optional yield on escrowed assets during settlement periods

Ecosystem Overview

Forwards connects to all major verticals enabling asynchronous,

trustless and permissionsless trade agreement & settlement

") -->|"BTC Trustless Bridge (coming soon)"| B("BTCfiBabylonSide

") -->|"BTC Trustless Bridge (coming soon)"| B("BTCfiBabylonSide  ")

B <-->|IBC| F("Forwards

")

B <-->|IBC| F("Forwards

") <-->|IBC| F

F -->|IBC| R("Real World AssetsOndoNoble

") <-->|IBC| F

F -->|IBC| R("Real World AssetsOndoNoble

")

style A fill:#1A1A1A,stroke:#40E0D088,stroke-width:2px,color:#FAFAFA

style B fill:#1A1A1A,stroke:#40E0D088,stroke-width:2px,color:#FAFAFA

style F fill:#1A1A1A,stroke:#40E0D088,stroke-width:2px,color:#FAFAFA

style P fill:#1A1A1A,stroke:#40E0D088,stroke-width:2px,color:#FAFAFA

style R fill:#1A1A1A,stroke:#40E0D088,stroke-width:2px,color:#FAFAFA

style E fill:#1A1A1A,stroke:#40E0D088,stroke-width:2px,color:#FAFAFA

")

style A fill:#1A1A1A,stroke:#40E0D088,stroke-width:2px,color:#FAFAFA

style B fill:#1A1A1A,stroke:#40E0D088,stroke-width:2px,color:#FAFAFA

style F fill:#1A1A1A,stroke:#40E0D088,stroke-width:2px,color:#FAFAFA

style P fill:#1A1A1A,stroke:#40E0D088,stroke-width:2px,color:#FAFAFA

style R fill:#1A1A1A,stroke:#40E0D088,stroke-width:2px,color:#FAFAFA

style E fill:#1A1A1A,stroke:#40E0D088,stroke-width:2px,color:#FAFAFA

Competitive Landscape

| Feature | Forwards | Traditional DEXs | Aggregators | CEXs |

|---|---|---|---|---|

| Capital Efficiency | 1-10% collateral | 100% pre-funding | 100% pre-funding | Variable margin |

| Cross-Chain Native | Seamless | No | Limited | Yes but centralized |

| Trading Future Assets | Yes | No | No | Limited |

| Privacy & MEV Protection | Enhanced | Vulnerable | Vulnerable | But centralized |

| Native BTC Trading | Direct | Wrapped only | Wrapped only | But custodial |

| NFT Trading Across Chains | Seamless | No | Limited | But centralized |

Go-to-Market Strategy

Phased Execution to Drive Liquidity, Adoption, and Growth.

“Trade Now, Settle Later” MVP

Early user incentives (airdrops, rewards)

Onboard market makers, liquidity providers, institutions

Awareness: roadshows, podcasts, partnerships

Trustless Bridge BTC Trading (via Bablyon)

Advanced UI & features

Add RWAs & NFTs

Enhanced incentive programs

Institutional adoption

Expand wallet/infrastructure partnerships

New asset classes

Global awareness campaigns

- Trading volume - Fees - Unique/repeat users - TVL in escrow - Unincentivized adoption - Bridging volume

Traction & Roadmap

Forwards has made significant progress and has a clear roadmap for the future.

✓ Completed Milestones

Concept validation with industry experts

Technical architecture design

Initial partnerships secured

Core team assembled

Core development started

Testnet Launch

Audit

Mainnet Launch with Initial Asset Pairs

Cross-chain Integrations Complete

Full Feature Set Live

Team — Refracted Labs

Veteran team of DeFi builders and financial experts, bringing traditional finance expertise and Web3 innovation together to revolutionize digital asset trading.

Olly

Co-Founder & CEO

Ex-Goldman Sachs & JPMorgan. 10+ years trading derivatives, high-yield, and distressed debt with top HFs & PE firms

Mo

Co-Founder & CTO

Led engineering for $20B AUM DeFi protocol.

6+ years blockchain, appchains, and DeFi infrastructure expert.

Core Team

Core Team Refractedlabs

Elite engineers, designers, mathematicians.

Built: money markets, yield tokenization, synthetic stocks, AMMs, TWAPs, Auctions etc.

Bootstrapped community from Refracted Labs projects, primed for Forwards

Fundraising

We are raising $2 million for 10% of the Genesis token supply.

Raising $2 Million for 10% of Genesis Token Supply

Investment Thesis

First Mover

Pioneering asynchronous settlement in DeFi

Market Size

Targeting trillion-dollar forward contract market

Network Effects

Value increases with each new user and market maker

Capital Efficiency

Unlocking 10x more capital for the ecosystem

Cross-Chain Future

Positioned for the multi-chain reality of blockchain

Future of Trading

Not all assets should be on a CLOB or in an AMM - illiquids & RWAs

Join the Future of DeFi Trading

Be part of revolutionizing DeFi trading with the first truly decentralized forward contract platform.

Contact Us